tennessee inheritance tax laws

This is a type of inheritance law where each spouse automatically owns. 0 out of 0 found this.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a.

. All inheritance are exempt in the State of Tennessee. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Technically Tennessee residents dont have to pay the inheritance tax.

It simply does not exist any longer. Tennessee Inheritance and Gift Tax. IT-1 - Inheritance Tax Repealed.

You could potentially be liable for three types of taxes if youve received a bequest from a friend or relative who has died. Very few people now have to pay these taxes. An inheritance tax a capital gains tax and an estate tax.

As of January 1 2016 Tennessees inheritance tax is fully repealed. If the total Estate asset. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan.

All inheritance are exempt in the State of Tennessee. Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Complete Edit or Print Tax Forms Instantly. There are NO Tennessee Inheritance Tax. The inheritance tax is different from the estate tax.

There three different ways to classify property for the sake of inheritance. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. Adopted children receive an.

Ad Download Or Email TN INH 302 More Fillable Forms Try for Free Now. Was this article helpful. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an.

Tennessee requires that children who inherit an estate under the Tennessee intestacy laws be the decedents legal descendants. As of December 31 2015 the inheritance tax was eliminated in Tennessee. For nonresidents of Tennessee an estate may.

Assets in excess of. However it applies only to the estate physically located and transferred within the state between. Tennessee is an inheritance tax and estate tax-free state.

For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. Those who handle your estate following your death though do have some other tax returns to take care of such. So there are no separate.

An executor is the person either appointed by the court or nominated in someones. The inheritance tax applies to money and assets after distribution to a persons heirs. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan.

The good news is that Tennessee is not one of those six states. Tennessee Inheritance Law FAQ Contents Executor Trustee. Only seven states impose and inheritance tax.

Ad Access Tax Forms. Additionally the Tennessee inheritance tax is now abolished in Tennessee for any person who dies in 2016 or later. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident.

A Whenever any property was held jointly by the decedent and one 1 or more persons as tenants by the entirety or. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is. The federal estate tax exemption is 5450000 for 2016 and is indexed for inflation.

Get an Estate Planning Checklist More to Get the Information You Need. It has no inheritance tax nor does it have a gift tax. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value.

Get an Estate Planning Checklist More to Get the Information You Need. The inheritance tax is levied on an estate when a person passes away. February 26 2021 1036.

Even though this is good news its not really that surprising. The federal estate and gift tax. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside. What is the inheritance tax rate in Tennessee.

The inheritance tax is repealed for dates of death in 2016 and after. 67-8-305 provides in its entirety as follows. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

How To Avoid Estate Taxes With A Trust

Behulpzaam Powerpoint Animation Charity 3d Man

What Is Inheritance Tax And Who Pays It Credit Karma

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Where Not To Die In 2022 The Greediest Death Tax States

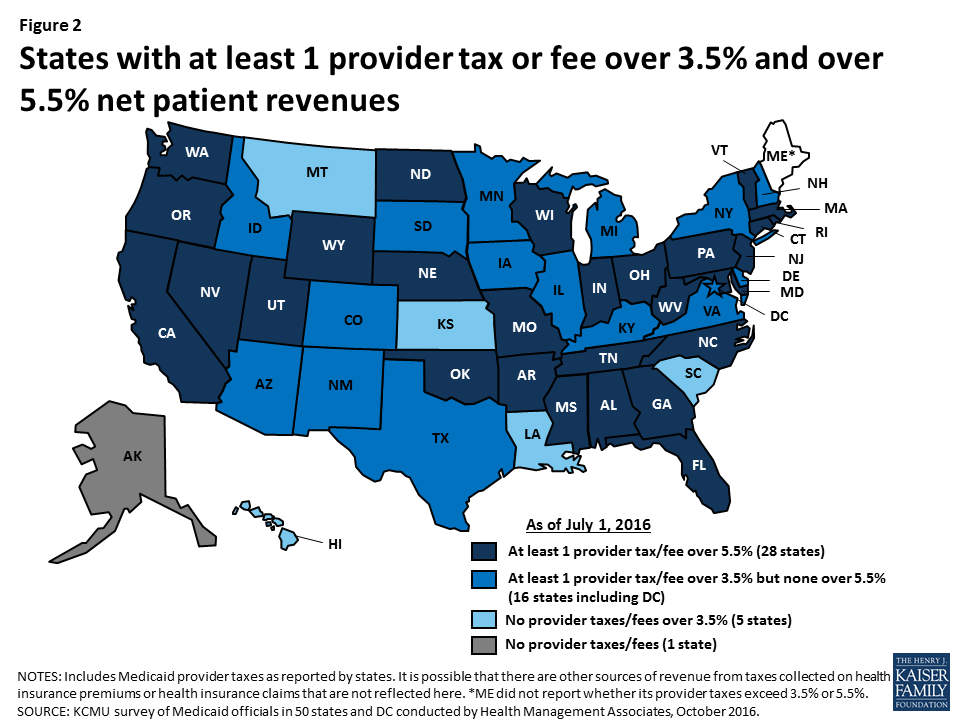

States And Medicaid Provider Taxes Or Fees Kff

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Are You Exposed To The New Jersey Estate Tax New Jersey Jersey Diploma Design